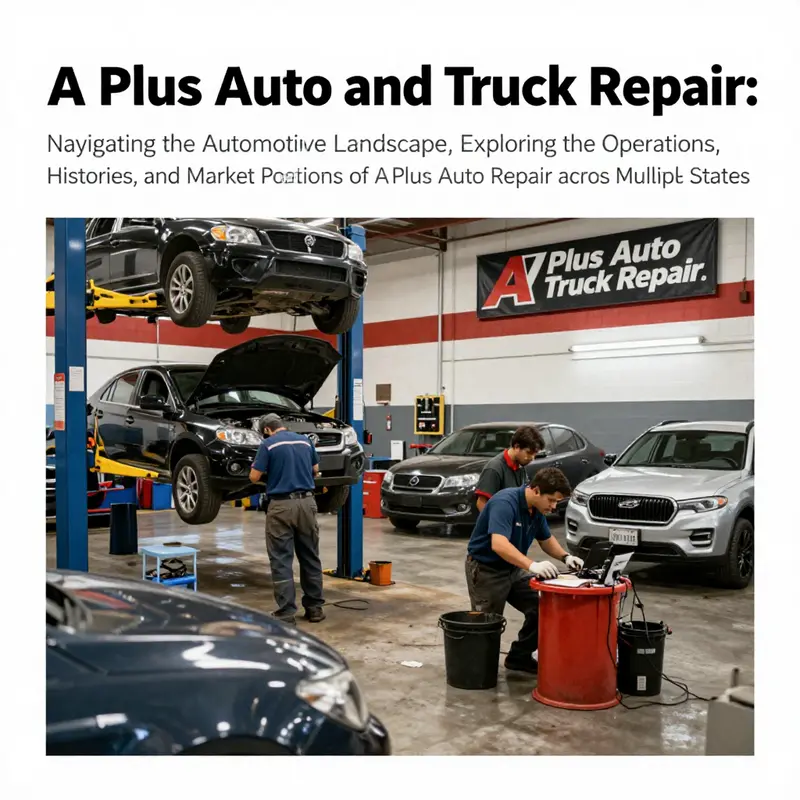

The automotive repair industry is a crucial component of vehicle maintenance and ownership, encompassing a wide array of services tailored for different vehicles, including motorcycles and trucks. Within this landscape, the entity known as A Plus Auto and Truck Repair emerges as a significant player, manifesting in multiple states under similar names, each with distinct operations. This article delves into the narratives of these entities across North Dakota, California, Utah, and Los Angeles, providing insights into their operational status, historical context, and market feedback. Each chapter builds a comprehensive view of how A Plus Auto and Truck Repair positions itself in a competitive environment while maintaining a focus on transparency, reliability, and service excellence for motorcycle owners, auto owners, auto parts distributors, and repair shops alike.

A Plus Auto Repair in North Dakota: Operating Realities and Growth in a Nascent Auto Aftermarket

In the North Dakota automotive landscape, A Plus Auto Repair stands as a small but persistent local shop. The entity is active and in good standing, with a listing in Bismarck. The public record, updated in 2023, confirms ongoing operation and a local presence at 3604 Global Dr.\n\nTo appreciate the operating realities, North Dakota’s economy relies on agriculture and energy, and dependable vehicle maintenance supports both farms and fleets. A Plus Auto Repair has presumably served private owners and local fleets, offering services from routine maintenance to diesel repairs, with emphasis on timely turnaround and clear communication.\n\nThe broader auto aftermarket trends—diagnostic tooling, service platforms, and fleet maintenance—shape opportunities for growth. For a small independent shop, success hinges on reliability, transparency, and the ability to respond quickly to common repair needs, while exploring partnerships with local businesses and service networks. In this regional context, the shop’s ongoing operation signals durability within a market that values practical, local service.

Tracing a Name: The Missing History of the California A Plus Auto Repair

When a business name appears across multiple places, tracing its California chapter can feel like following a faint trail. The records for a California-registered company named “A Plus Auto Repair, Inc.” are sparse. Public filings show a registration date in 2002 and a later dissolved status. Beyond those basic data points, there is no detailed corporate history available in the materials we reviewed. That absence matters. Customers, regulators, and anyone trying to verify a shop’s pedigree need more than a name. They need context, continuity, and clear signals that the business they find today is the one they intend to work with.

The plain fact of dissolution in state records means the entity ceased to be active under that particular legal registration. Dissolution can be voluntary or compelled. It can follow a simple closure, a merger, or a failure to file required paperwork. A dissolved filing does not erase every trace of operations. It does, however, usually end the entity’s legal authority to contract or operate under that exact corporate identity. For people searching for repairs, warranty records, or an accountable business, a dissolved status is a red flag. It requires extra steps to confirm whether a successor or related shop took on the business, assets, employees, or customer obligations.

Companies with the same or similar names often coexist across states. This can lead to confusing overlaps in search results, directories, and online review sites. One “A Plus Auto Repair” might be active in North Dakota. Another might have an expired registration in Utah. A separate location in Los Angeles may show current activity in online directories. All three carry similar names but different legal statuses and operational realities. For anyone trying to locate the specific California operation referenced in older documents, this overlap complicates verification.

Why do historical details vanish from readily available sources? Several factors contribute. Small auto shops frequently operate as sole proprietorships or limited-liability companies. Those structures can change quickly. Owners may file dissolution to avoid tax or compliance liabilities. In other cases, a business may continue operations under a new name or different ownership, without formally transferring or preserving the old company’s public records. Furthermore, online directories or review platforms sometimes retain business pages even after official dissolution. That can give an illusion of continuity where none exists.

Understanding what dissolution does and does not imply helps set expectations. Dissolution documented with the Secretary of State ends the entity’s legal authority under that name. It does not automatically mean physical premises closed the day the filing was processed. It does not always clarify whether debts were paid, records archived, or warranties honored. Those matters depend on how the dissolution was handled and whether a successor business assumed responsibilities.

For customers or partners trying to interpret a dissolved record, practical verification steps make sense. First, check the Secretary of State or similar registry for the filing details. The filing date, the listed agent, and any accompanying notices can reveal whether dissolution followed typical wind-down procedures. Second, search regional business licensing databases and county records. Local business licenses, tax registrations, or health and safety inspections can show whether the physical shop remained active after a state-level dissolution filing. Third, review archived web pages and news items. Tools that capture historical website snapshots can show whether an operation continued under a different brand. Fourth, ask directly. A visit or phone call to the physical address can clarify who occupies the space and whether any current business continues prior operations.

If the goal is to locate a current, trustworthy provider that matches the name, focus first on live signals. Active licensing, recent inspection reports, up-to-date business listings, and recent customer reviews usually matter more than an old corporate filing. For instance, an L.A.-based shop listing on a directory may display recent activity claims. North Dakota filings may show a separate active entity under a similar name. Cross-referencing those signals can help separate distinct businesses from one another. If a specific location’s continuity matters for service history or warranty cases, insist on seeing contractual documents that link the new shop to the old corporation.

There are also legal and reputational layers to consider. A dissolved company that still uses its former name in public advertising can create liability risks. Customers may assume legal protections that no longer apply. Vendors and insurers may be unaware of a dissolution and thus fail to enforce protections tied to the original entity. For people dealing with recalls, salvage titles, or warranty disputes, establishing whether a present business is a legal successor is essential. That often requires a careful review of purchase agreements, asset-transfer documents, or contracts showing assumption of liabilities.

For researchers and writers documenting a company’s arc, the absence of a full corporate history means shifting emphasis to verifiable traces. Primary sources include public filings, local permits, and credible directory listings. Secondary sources such as media coverage or community records can help, but they must be cross-checked. In our review, only minimal data surfaced for the California registration: a 2002 start date and a dissolved status. No deeper records were available. That scarcity suggests the need to broaden the search beyond state filings and to rely on local records, archived web pages, and direct inquiries where possible.

When there is potential for multiple similarly named shops to be confused, a practical way forward follows a standard checklist. Verify the exact legal name and its jurisdiction. Confirm active licensing and recent inspections. Compare business addresses and ownership names across filings. Look for trade names or “doing business as” registrations that might link different corporate names. Obtain copies of invoices, warranties, or contracts that show continuity of service. If records are needed for legal or warranty claims, consider seeking formal verification through a licensed investigator or an attorney.

Finally, when a customer is simply trying to find a reliable repair shop, the most useful path is direct contact with the current, active provider at the specific address. For those tracing the California operation mentioned in older notes, the available evidence does not support a continuous corporate history under that exact name. The dissolved filing ends the paper trail. But it does not fully resolve who continued the work, who inherited customer obligations, or whether current listings represent the same business. In practice, the clearest approach is to reach out to the currently operating shops with matching names, ask for proof of service history, and confirm what warranties, records, and parts guarantees remain in effect.

For background reading on how similarly named service shops map across regions, see this overview of A Plus Auto Repair distribution and presence: A Plus Auto Repair footprint.

If deeper verification is needed, focus on authentic records. County transactions, archived websites, and direct statements from past owners or managers are the best sources. When corporate records are thin, those localized, verifiable traces become central to reconstructing what actually happened at the California location.

Utah’s A Plus Auto Repair: What the Registration Silence Means and How to Verify Operations

A Plus Auto Repair in Utah: understanding absence of records and practical verification steps

When a business name appears in multiple places but not in the official records for the state where you expect it, the gap matters. For A Plus Auto Repair in Utah, the available data does not show a current, active registration. That absence does not always mean the shop is closed or illegitimate. It does mean you must treat the situation with care, and follow a clear verification process before relying on that business for vehicle work or before using the name in any formal context.

The first thing to understand is what missing or expired entries typically imply. A company listed as expired in a state registry usually failed to renew its registration or report required information. That status can be administrative, not criminal. A dissolved designation, by contrast, means the entity was formally terminated. Both statuses differ from active or good standing, which indicate the state recognizes the business as properly registered and compliant. For consumer or partner decisions, an active registration reduces risk. But absence of an entry in publicly available snapshots is not proof alone of fraudulent intent.

Because your knowledge base lacks Utah-specific records for A Plus Auto Repair, the next step is targeted verification. The state’s Division of Corporations and Commercial Code provides the authoritative registry for business entities. A search there will show whether a name is reserved, active, expired, or dissolved. If the entity is not found, it could be operating under a different legal name, as a sole proprietorship, or as a DBA (doing business as). It might also be unregistered — an arrangement that carries potential liabilities for both operator and customer.

Parallel to a state search, confirm tax and licensing status. A legitimate repair operation typically holds local business licenses and complies with state tax filings. The state tax commission can show whether the business is registered to collect and remit sales and local taxes. Municipal business licensing offices will show whether the shop holds a city or county license. Insurance and bonding information may appear on municipal permit records, or you can request a certificate of insurance directly from the shop. If the shop cannot or will not provide proof of required insurance, treat that as a major warning sign.

Online listings are helpful but not definitive. Directory sites and review platforms can show a store that appears active. These listings sometimes lag behind registration changes. A shop might display an address and phone number while its legal registration has lapsed. Conversely, a dissolved legal entity can still operate under a different name. Use online listings as a starting point, not as confirmation. When you find a listing, cross-check the address and phone number with public records. If a storefront exists at that address, visit in person or call to ask for licensing and tax information.

If you are trying to identify whether the Utah A Plus Auto Repair is the same business referenced in other states, remember that identical or similar names often belong to unrelated firms. The auto repair trade commonly uses simple, descriptive names. That leads to numerous independent entities sharing near-identical titles. Never assume common ownership from a shared name. Ask directly for legal business name, tax identification, and the entity’s formation state. Those details clarify whether you are speaking to the Utah operation or a company registered elsewhere.

For owners or prospective owners, the path to clarity is straightforward. If a business is operating but not registered, file the appropriate formation or trade name documents with the state. Register for state tax accounts and secure any required municipal licensing. If the business once existed but lapsed, Utah provides reinstatement or revival procedures for some entities. Follow official instructions closely and retain confirmation receipts. These steps protect both the owner and customers, and they also restore public records so third parties can verify the business easily.

From a customer’s perspective, practical diligence reduces risk. Before authorizing significant repairs, request the shop’s legal name and tax ID. Ask for proof of insurance and workers’ compensation coverage. Check whether the technician holds relevant state or local certifications where applicable. Ask for written estimates and a clear scope of work. Keep copies of invoices, diagnostic reports, and any communications. If you plan to finance repairs or claim warranty coverage, documentation will matter.

If you encounter resistance or inconsistent answers, escalate carefully. Contact the local licensing office and the state Division of Corporations to report the discrepancy. You may also check with consumer protection agencies for complaints. If you suspect fraud or unsafe practices, report to the appropriate enforcement authority. Preserve written records of exchanges, estimates, and receipts. Those records help regulators and may support a future dispute resolution.

There are effective techniques for verifying an elusive shop beyond state registries. Conduct an address verification. Visit the physical location listed in online directories. Note signage, posted license numbers, and any business permits displayed. Speak with technicians and ask where parts are sourced, whether warranties apply, and who is the legal owner. A legitimate shop answers clearly and supplies documentation without delay.

Use commercial databases when public records are unclear. Business credit firms and background-check services often maintain records that go beyond state filings. They can show trade credit, historic filings, and prior addresses. These reports may cost money but can reveal an entity’s operational history. For a prospective customer or partner facing uncertainty, the cost can be a reasonable investment compared to the potential losses from poor work or fraud.

Finally, document your verification steps so you have a defensible record. If you will rely on the shop for ongoing fleet maintenance or for work that affects safety, ask for a written service agreement. Spell out responsibilities, timelines, warranties, and dispute resolution. When legal status is ambiguous, contractual clarity compensates for record gaps. It also forces the shop to state whether it is registered, and if not, why not.

If you seek guidance specific to Utah filings, start with the state corporation search. The Division of Corporations provides filing records, status codes, and procedural guidance for reinstatement or formation. If your search returns no record for A Plus Auto Repair, broaden the query to owner names, trade names, and variants. Many legitimate shops operate as sole proprietorships that do not appear in corporate registries. Confirming tax, licensing, and insurance remains essential in those cases.

For convenience, here is a resource to begin a formal state search: https://corporations.utah.gov

Throughout this process, treat the absence of a registrant as a question, not a conclusion. Follow the verification steps described here. Ask for documentation. Use public and commercial records. Insist on written estimates and proof of insurance. Doing so will protect you, and it will clarify whether Utah’s A Plus Auto Repair is an active, compliant business or a name that requires further scrutiny.

For background on how similar names can create a confusing footprint online, see the internal overview on a-plus-auto-repair-footprint. This resource helps explain why multiple listings may exist, and why an active record in one state does not confirm operations in another.

洛杉矶地区的A Plus Auto Repair:同名门店的真实运营与市场反馈

在洛杉矶这座车水马龙的城市,汽车维修市场呈现出一个有趣且微妙的现象:多家以“a plus auto repair”或极其相近名称命名的门店在同一区域并存,但它们往往是相互独立的实体,而非同一个公司分支。这种现象并非罕见,也并非单纯的 branding 效应使然,而是由市场需求、地区法规、以及信息传播的多样性共同作用的结果。基于最新的本地信息,洛杉矶地区已经出现几家具有明确地址与营业活动的同名门店。最具参考性的三家分布在不同的社区:一是在西区的15709 Saticoy St,91406的门店,另一家在Sun Valley的9011 Sunland Blvd,91352,第三家则是位于Hawthorne的3820 W El Segundo Blvd, Ste D,90250。它们的公开信息显示,三家门店不仅在营业时间上存在差异,也在服务定位上呈现各自的侧重点。通过对公开照片、客户评价及营业状态的整合,可以得到一个清晰的市场画像,而这也是理解“同名门店”背后真实运营状态的关键。以西区门店为例,其在2026年初通过Yelp等平台持续更新信息,店内有约17张照片与若干条用户评论。评价的内容通常集中在专业性、效率、以及对复杂维修的处理能力等维度。Sun Valley门店则显示出更长的营业时间,延伸至晚上,给上班族提供更大的便利。Hawthorne门店在照片数量上领先,达到约21张,照片多半聚焦于施工环境、维修前后对比和工作细节,这在加州市场中常被消费者视为对服务质量的直观呈现。以下三家门店的存在,折射出洛杉矶市场对独立维修店的持续需求,也揭示了一个重要事实:同名并非统一品牌背书,消费者在选择时需要以地址、服务范围、以及实际营业状态为基准来判断。为了更好地理解这背后的机制,可以把品牌足迹作为一个线索来追踪地区内的信任建立过程。就此而言,了解“A Plus Auto Repair footprint”的公开描述尤为有用。该资源强调,当同城存在多家同名门店时,透明的地点信息、清晰的服务定位,以及对客户反馈的持续回应,是建立信任的关键手段。消费者在评估时,可以将这类 footprint 视作导航工具,帮助区分真实的运营主体与潜在的混淆点。与此同时,洛杉矶地区的多门店现象也提醒行业从业者,强有力的线上形象管理并非可选项,而是维系本地口碑与生意持续性的必要条件。照片的数量、更新的频率、以及对服务细节的呈现,往往与客户的信任感直接相关。Hawthorne门店以其较多的工作场景展示,似乎在构建“环境信任”的策略;Sun Valley门店则通过延长营业时段传达“可及性”的承诺;西区门店的适时更新和现场照片则反映出对“专业程度”与“透明度”的强调。综合来看,这些特征并非偶然,而是小型独立维修企业在竞争激烈的洛杉矶市场中寻求生存与成长的策略体现。它们共同塑造了一个关于“同名并存”在地市场的动态现实:品牌名并不能自落地就成就信任,反而需要通过稳定的信息发布、清晰的定位、以及持续的客户互动来建立可靠的形象。对于正在寻找服务的车主来说,最重要的并非单纯地被“名字”所吸引,而是要看清该店在具体位置、现在的营业状态以及它能提供的具体服务。就此而言,消费者应当优先核实门店的实际地址及其经营许可的有效性,这在 California 的监管框架下尤为关键。另一方面,服务范围的明晰也不容忽视。例如,在加州,许多小型门店会提供从日常维修到尾气排放检测等多样化服务,后者在本地法规环境中具有特殊的市场需求。这样的定位不仅影响客户的选择,也决定了门店在竞争中的定位与差异化能力。多点存在的同名门店提供了一种“就近可及”的便利,但与此同时,也带来信息错配的风险。消费者在找到一家看似合适的门店后,应尽可能通过电话或亲访确认当前营业状态、是否接受你需要的具体服务,以及价格区间的透明度。除此之外,门店的线上形象、照片更新频率、以及对客户反馈的回应速度,都是衡量其专业性的重要信号。若以行业对比来看,A Plus Auto Repair 在洛杉矶的几家门店通过上述要素维持了持续的市场曝光度,这也说明了在美国西海岸诸多小型维修企业普遍面临的共性挑战:如何在品牌同名、信息多源、以及服务细分的现实中,保持清晰的市场定位与高效的客户沟通。对行业观察者而言,这一现象提供了一个有价值的案例:当“同名效应”成为常态时,客户教育与信息透明就成为最直接的品牌资产。若要在广义层面把握这类市场现象的深层含义,除了看店面的照片与评论,还应关注经营者对可靠性与服务承诺的持续兑现。最终,洛杉矶的三家门店共同构成一个更大图景:独立维修店在大城市仍有生存空间,但要赢得当地消费者的信任,必须以地址的准确性、业务范围的清晰以及互动的及时性作为基石。对车主而言,这意味着在寻求维修时,不应只被门店名吸引,而应以“在哪儿、做什么、何时能完成、价格是否透明”作为判断的核心。对行业而言,这样的市场格局也促使从业者加快数字化步伐,提升线上线下信息的一致性,并以更高的服务标准来对抗潜在的混淆风险。外部资源的帮助同样重要,诸如 Yelp 之类的用户生成内容平台,既是市场信息的一部分,也是消费者决策的重要依据。通过这些渠道,消费者可以获取门店的真实运营状态、顾客体验的多元视角,以及对某些维修项目的实际处理效果。外部参考资源: https://www.yelp.com

Navigating the Fragmented Brand Landscape: A Plus Auto and Truck Repair in a Diverse Auto-Repair Market

The automotive service market exists at the intersection of local trust, regional legacies, and rapidly evolving technology. When a single brand name appears across multiple states with subtly different legal statuses and public profiles, it reveals more than administrative quirks; it exposes the broader dynamics of how repair services are perceived, sourced, and valued by drivers in an increasingly complex mobility ecosystem. In this context, the story of A Plus Auto and Truck Repair becomes a case study in how a familiar, service-oriented identity must navigate a landscape that is at once highly local and surprisingly global in its pressures. The material at hand, though not detailing a single corporate narrative for the brand, presents a mosaic of distinct entities that share similar nomenclature, each carrying its own operational risks, reputational signals, and growth possibilities. The critical takeaway for any chapter exploring the competitive terrain is not merely where a shop is located, but how it communicates reliability, legitimizes its presence, and leverages technology to differentiate itself in a crowded field that ranges from mom-and-pop garages to regional chains with national ambitions.

A closer look at the four notable entries bearing the A Plus Auto Repair name helps illuminate these dynamics. In North Dakota, there is an entity identified as a-plus auto repair inc., described as active and in good standing. Founded in 2018 and registered in North Dakota, this shop operates from a listed address in Bismarck, and public records indicate that its status was updated as recently as 2023, underscoring a credible, ongoing operation. The timing matters because a business that sustains its license, remains compliant, and maintains a physical address signals stability in a market that rewards predictable service and transparent accountability. For customers, that translates into a risk reduction: a known storefront, an address they can visit, and filings they can verify. Yet, even with such signals, the name alone remains a potential source of confusion when drivers encounter other similarly named shops in different states.

In California, the landscape looks markedly different. A-plus auto repair inc. there is noted as dissolved, with historical registration dating back to 2002 and a Montebello location on Van Norman Road. The dissolution status is an important reminder: not all entities sharing a name endure, and the absence of active status can create a disconnect between a consumer’s expectation and the reality on the ground. Customers who encounter a dissolved entity might assume a long-standing operation has shuttered, even if a new or similarly named business later emerges elsewhere. This nuance matters because local trust builds incrementally; once a brand’s legal status becomes unclear, the perceived reliability of the service itself can be called into question, even if a different shop with a similar name is actively serving customers nearby. The record invites scrutiny of how branding, licensing, and public-facing communications align to avoid misinterpretations that could undermine loyalty.

Utah’s entry—another variation, a Plus Auto Repair with an expired registration since 1999—adds a different layer to the ambiguity. An expired status, even if the business had once offered consistent service, signals cessation in the eyes of regulators and potential clients. It is a stark reminder that a repair shop’s reputation hinges not only on the quality of its work but on the continuity of its legal and operational presence. An expired entity might still influence local awareness; drivers may recall a name and associate it with dependable service in the community, even as the actual business no longer exists in a compliant form. This underscores a broader lesson for the market: competitive advantage is sustained not just by technical skill, but by ongoing regulatory alignment, active licensing, and visible proof of continued operation.

Meanwhile, a functioning storefront bears fresh relevance in Los Angeles. Yelp listings indicate an A Plus Auto Repair Inc. shop at 15709 Saticoy Street with a reachable phone line, and the data point was updated in 2026, suggesting recent activity. A single shop in a major urban market like Los Angeles embodies a different strategic posture. In dense urban areas, competition is fiercer, and consumer expectations for speed, convenience, and digital responsiveness are higher. A store that maintains current contact information, appears in local directories, and shows recent activity demonstrates a responsiveness that resonates with drivers who rely on fast, dependable service. Taken together, these snapshots reveal a spectrum: a brand that may be legitimate and active in one state, dissolved in another, and alive in a third, with yet another modern storefront carrying the same name and potentially reaching a different customer segment.

The contradictions across jurisdictions naturally raise the question of how customers—and practitioners—identify a trustworthy provider. In a market that mixes family-owned garages, small regional players, and expanding chains, the risk of brand confusion grows when the same or similar names proliferate. For a consumer, the decision process can hinge on a handful of signals: active licensing, local storefront presence, straightforward contact details, and a demonstrable history of service. In practical terms, a driver checking for a quick repair or routine maintenance may begin with a name they recognize, then verify the shop’s status through local business registries, licensing boards, and recent customer reviews. The challenge becomes how a brand like A Plus Auto and Truck Repair can ensure that such signals point toward trust rather than ambiguity. The LA storefront’s ongoing operation offers a model for maintaining visibility and credibility amid a landscape where several entities share the name, though it, too, must stay vigilant to ensure its identity remains clearly distinguished from dissolved or expired predecessors.

The broader market context also shapes how a repair provider competes and how customers perceive value. The auto repair sector has, in recent years, moved beyond the traditional service paradigm toward a more integrated set of capabilities. Technological shifts—ranging from digital diagnostic tools to advanced driver-assistance systems and battery management—have redefined what customers expect from a shop. Beyond fixing brakes and replacing filters, drivers anticipate faster turnaround times, accurate diagnostics, and the potential for remote monitoring or digital updates that keep vehicles safe and compliant with evolving standards. In this environment, a brand that combines accessible, trustworthy local service with a willingness to adopt new diagnostic and data-enabled offerings can differentiate itself from the “old-school” repair shop while competing with larger regional players that leverage scale.

One way to conceptualize the competitive landscape is to view it through both the lens of reliability signals and the lens of innovation signals. Reliability signals include licensed operation, transparent business address, verifiable records, and consistent customer communication. Innovation signals, on the other hand, encompass the adoption of digital tools, integration with vehicle networks, and the ability to offer services that align with new mobility trends, such as electric vehicles or connected-car technologies. In a market where the same brand might operate under multiple legal identities, aligning these signals becomes even more crucial. A Plus Auto and Truck Repair, or any similarly named enterprise, must not only prove it exists but prove that it sustains a consistent standard of care across the board. The Los Angeles storefront, being actively listed as of 2026, points toward the possibility that the brand’s strongest signals are being cultivated closest to dense customer bases where visibility matters most. Yet, to build lasting trust, the organization must ensure that each location adheres to uniform quality standards and that customers can reliably trace back to a consistent set of assurances—licensing, warranties, and a track record of transparent pricing and service.

This is where the idea of a brand footprint becomes meaningful. The chapter’s research material hints at the need for a cohesive identity that travels well across jurisdictions. An effective footprint goes beyond a single address or a phone number; it embodies a set of practices that customers associate with the name—clear communications, dependable scheduling, visible certifications, and a modern approach to diagnostics and repair. The existence of a documented footprint, such as the one noted in the internal material for A Plus Auto Repair, can serve as a powerful differentiator in a crowded field. Customers may not read every license, but they can sense when a brand consistently demonstrates its presence and reliability in the places where they live and drive. In this sense, the LA storefront’s ongoing operation can be interpreted as part of a broader strategic posture: maintain local accessibility while gradually building a reputation that travels through word of mouth, reviews, and the reassurance of a recognizable name.

From a strategic perspective, the market’s diversity invites a more sophisticated approach to growth. Rather than betting on a single location or a narrow service menu, a brand like A Plus Auto and Truck Repair could pursue a multi-faceted strategy that leverages its footprint while incorporating scalable, technology-forward services. This could include investing in robust diagnostic capabilities, training technicians in ADAS recalibration and battery management, and adopting transparent digital workflows that provide customers with real-time updates on diagnostic findings, parts availability, and expected completion times. A stronger emphasis on data-driven service recommendations could also help shift the customer relationship from reactive repairs to proactive maintenance. Importantly, any expansion plan must be underpinned by rigorous compliance with local licensing requirements and a clear, consistent brand message that reduces confusion across states. The goal is not merely to replicate a successful model in another market, but to ensure that the brand stands for dependable workmanship, fair pricing, and clear communication across diverse regulatory environments.

Projects of this kind often benefit from a careful alignment between the physical and digital identities of the brand. A Plus Auto Repair footprint, as reflected in available materials, can serve as a foundation for a cohesive narrative that customers can verify through simple checks—licensing records, a current address, and recent customer feedback. Meanwhile, the market reality remains that drivers are increasingly savvy about where they seek service. They compare not only price and speed but also the caliber of diagnostics, the transparency of recommended work, and the availability of warranties. A brand that can articulate these strengths with clarity and consistency—while maintaining compliance in each jurisdiction—will stand a better chance of converting initial inquiries into long-term loyalty. The competitive landscape, though punctuated by entities with similar names, rewards those who translate reputational signals into tangible, repeatable service experiences.

For readers tracking the practical implications of these observations, a concrete takeaway is the importance of verifying a shop’s active status and official credentials before engaging services. The data points—active in North Dakota, dissolved in California, expired in Utah, and active in a major California city—highlight how easy it is for a customer to encounter conflicting signals. Customers should visit a location if possible, check state business registries or licensing boards, and review recent customer feedback to gauge ongoing reliability. If a customer considers a specific shop that aligns with the brand name, an additional prudent step is to explore whether the shop participates in a wider footprint and adheres to uniform service standards across locations, such as standardized warranties, transparent pricing, and consistent technician training.

The broader narrative of A Plus Auto and Truck Repair thus emerges as a reminder that success in the auto repair ecosystem hinges on a balanced blend of trust-building signals and forward-looking capabilities. In markets saturated with options, the brands that survive and thrive will be those that demonstrate reliability through licensure and storefront presence while investing in the capabilities that modern drivers demand. A Plus Auto Repair, in its various incarnations, embodies this tension between legacy local service and the promise of technology-enabled, data-informed maintenance. The path forward for any such brand is to fuse the credibility of a well-documented footprint with the agility to adapt to new mobility challenges, thereby creating a durable competitive edge that resonates with drivers, regulators, and the communities they serve.

Internal link note: for readers interested in how a brand’s footprint is communicated in practice, see the discussion of A Plus Auto Repair footprint linked here: A Plus Auto Repair footprint. This concrete example can help illustrate how a local shop communicates reliability and consistency across a broader geographic footprint. External context on the evolving aftermarket landscape can be found at industry coverage that discusses the convergence of traditional repairs with digital diagnostics and data-driven service, offering a complementary lens to the brand-focused narrative presented here: https://www.autonews.com.

Final thoughts

The exploration of A Plus Auto and Truck Repair across various states paints a dynamic picture of the automotive service industry. With active operations in North Dakota and Los Angeles, contrasted with the dissolution and expired status of others, it becomes evident that not all iterations of the name share the same fate. Understanding the nuances of each entity reinforces the importance of reliability and informed choices when selecting automotive repair services. For motorcycle and auto owners, knowing the local landscape helps ensure you receive the best possible care for your vehicles, highlighting the significance of reputable service providers like A Plus Auto and Truck Repair.